VOD and SVOD services take root in France

Tuesday, March 13th, 2018

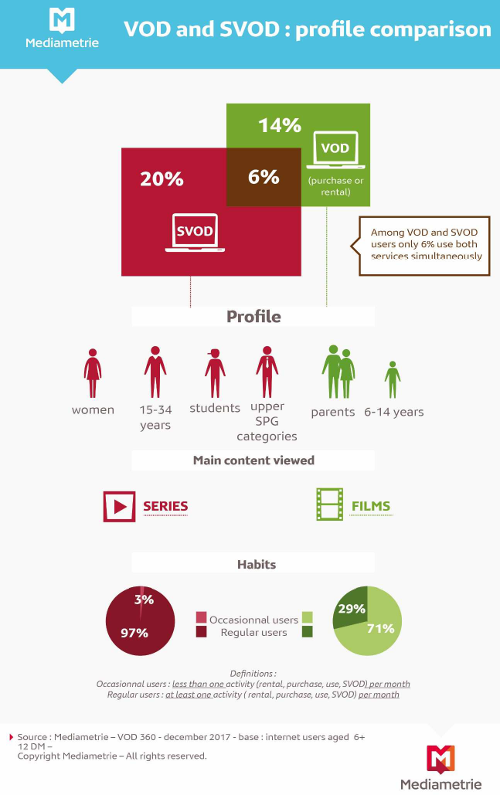

LEVELLOIS — Almost 2 out of 5 French internet user has already used VOD* or SVOD** services, a steady increase. Over the last 12 months, 13% of the population indicated they had rented at least one video, and 20% have used a SVOD service.

SVOD’s primary strength lies in the diversity of content. Users of SVOD aged 15 years and over in particular are “series-addicts” . Despite the domination of American series, 56% of respondents said it was important for them to have an SVOD catalogue that contained French productions of films and series.

User practices catching on fast

37% of internet users aged 6 years and over in France said they had already used VOD* or SVOD** services (as the subscriber or otherwise) at least once. This represents an 11-percentage point increase on 2016.

Over the last 12 months, 20% of internet users have used an SVOD service at least once.

37% of internet users could spontaneously name a VOD or SVOD platform. A stable figure, despite the arrival of acknowledged new players. The VOD market is characterised by a pattern of platform creation and demise. What with the arrival of new players, the ad infinitum versions of the umbrella brands, and the abundance of services on offer, it can be a challenge to form a clear and simple picture of these platforms and services.

SVOD : increasing success and high satisfaction

SVOD is a service that is shared. On average, three people actually use one SVOD within the same household.

The profile of SVOD users is broadening as these usages become more widespread amongst the population. This audience includes more women, is hyper-connected and more typically subscribes to a paid-for channel than internet users as a whole would. It also shows a strong affinity for video activity, regardless of the screen used.

Platform accessibility and a wealth of content: the winning combination

SVOD’s primary strength lies in the diversity of content. All programme genres are available to watch: series (91%), films (87%), cartoons (44%) and documentaries (40%).

Users of SVOD aged 15 years and over in particular are “series-addicts” who watch insatiably: 92% watch several episodes in a row and 83% binge watch***. In total, each user watches more than 11 series on average in a year, including more than seven that are available exclusively on a platform.

Moreover, series addicts have adopted all the functionalities available on the platforms: picking up a programme where they had left off, multi-screen access and account sharing were the most popular.

The wealth of recent and quality content, coupled with ease of access and ease of use, have allowed the platforms to achieve some very high satisfaction scores: 8.3/10 on average.

Call for the French Touch

Among the top 10 most followed SVOD series, there is a notable supremacy of American series, despite a manifest desire to see more “Made in France” creations: 56% of respondents said it was important for them to have an SVOD catalogue that contained French productions of films and series.

VOD rental: slow but steady

13% of the population indicated they had rented at least one video during the previous 12 months, which was two percentage points higher than the previous year (11%).

Owing to the viewing quality offered, the TV set remains the preferred screen for video rentals. On average each year, a VOD user rents five times, mostly for films.

In general, VOD users are overequipped with screens and oversubscribed to paid-for services. Furthermore, they regularly enjoy audio-visual activities such as going to the cinema or watching video in all its forms (free / paid for on the internet, DVD, recordings, and even pirated).

VOD purchasing, still a restricted practice

Only 8% of internet users indicated that they had already purchased a VOD. The profile of these buyers was quite similar to the profile of VOD rental users, and they used several screens. Although films remained a big attraction, series and cartoons were also popular content types.

On average each year, a household bought four videos, and the heaviest consumers were those homes with children under 15 years of age (8 videos per household annually).

* VOD: Video on Demand: pay-per-view rental or purchase of a video

** SVOD: Subscription Video on Demand – video subscription service

*** Consecutively watching several episodes of a series available to watch in full

Methodology and objectives of the VOD360 study

The VoD360 study was conducted online (CAWI) from 27 December 2017 to 15 January 2018 among 4,130 web users aged 6 years and over.

Its objectives: Understand the recognition of VOD platforms. Assess the population size and profile of VOD, SVOD and catch-up users. Understand practices and uses of pay-per-view VOD and SVOD (screens, platforms, genres, those watching, times, etc.) Understand the decision-making process for a VOD platform and the selection criteria for a VOD. Assess satisfaction with VOD platforms, motivations and obstacles, criteria which encourage VOD and SVOD.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization